Fusang Depository Receipts

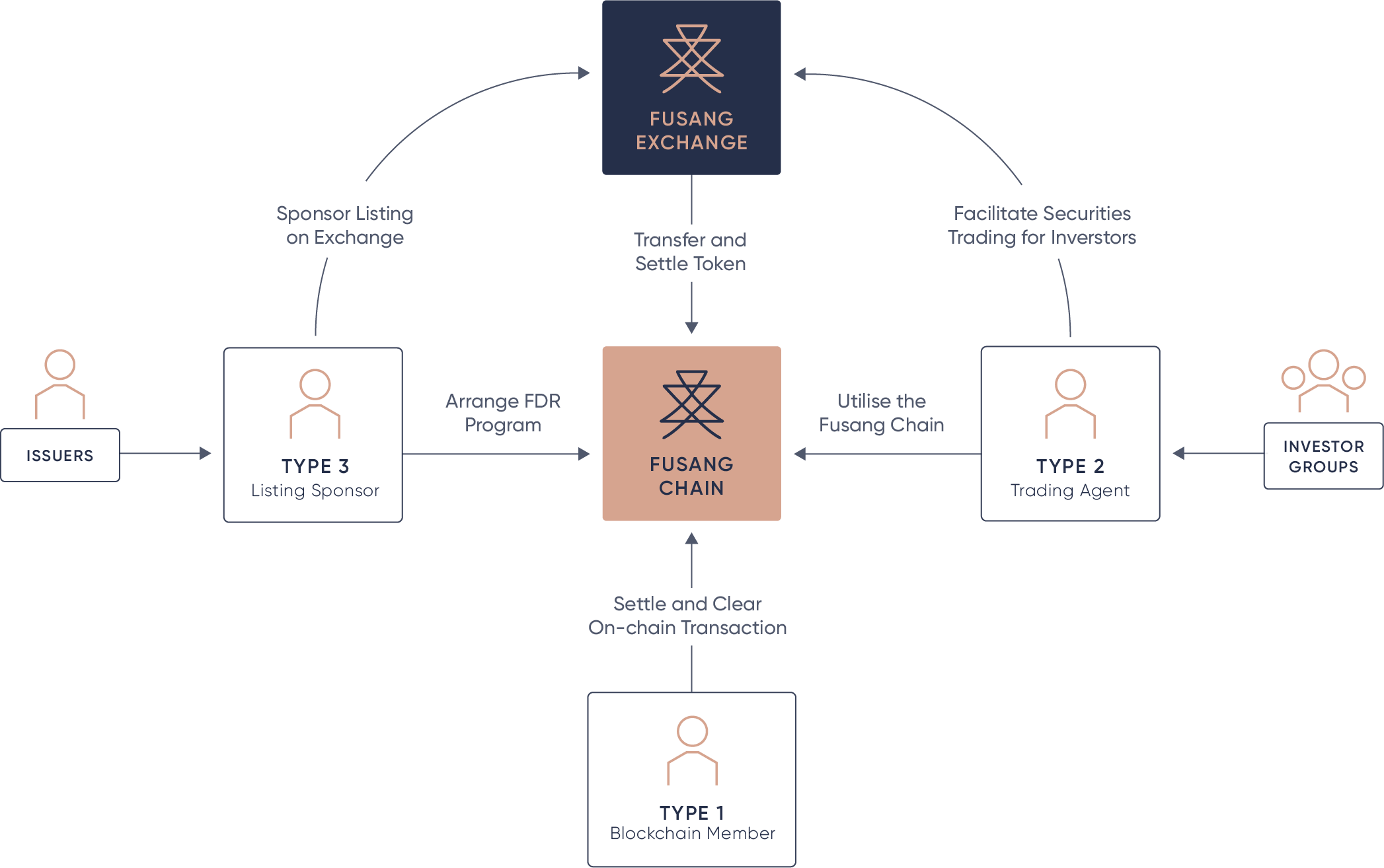

Fusang Depository Receipts ("FDRs") are similar to other depository receipt programs such as American Depository Receipts ("ADRs") and Hong Kong Depository Receipts ("HDRs"). Depository receipts are tradable instruments that represent a beneficial interest in an underlying asset, such as shares or bonds. FDRs are issued by Fusang Exchange as Depository, and can be listed for trading on the Fusang Exchange. All underlying assets are secured by third-party custodians. FDRs can be directly redeemed in exchange for the underlying asset. New issuance and listing of FDRs through Fusang Exchange requires the appointment of a Type 3 Listing Sponsor.

Introduction

What are Fusang Depository Receipts?

- Fusang Depository Receipts (“FDRs”) are similar to other depositary receipt programs such as American Depository Receipts (“ADRs”) and Hong Kong Depository (“HDRs”).

- Depository receipts are instruments that represent a benefit interest and direct legal claims on the underlying asset, such as shares or bonds.

- FDRs are issued by Fusang Exchange Ltd as Depository and such FDRs are the digital form representing underlying assets held in the Depository.

- New issuance and listing of FDRs on Fusang Exchange requires the appointments of a Listing Sponsor. Such FDRs can be then listed, traded and settled on the Fusang Exchange.

- Underlying assets of FDRs are secured by third-party independent custodians.

- Investors can instruct Fusang Exchange via their Fusang Exchange Member to acquire specific underlying assets for the purpose of issuing FDRs representing those underlying assets.

- FDRs can be directly redeemed in exchange for the underlying assets.

Increased Liquidity & Fractionalisation

Holding traditional assets often has a minimum investment size and limited liquidity. In contrast, investors can trade a fraction of such traditional assets in the form of FDR on the Fusang Exchange.

This fractionalisation lowers the entry barriers for investors, allowing them to diversify their portfolios. The smaller investment amounts make the FDR tokens more accessible to a wider range of investors to enhance liquidity and narrow bid-ask spreads.

24/7 Trading & Global Market Access

Fusang Exchange operates on a 24/7 basis, offering continuous trading and investment opportunities for investors from different time zones at any time of the day or night. This accessibility provides greater flexibility to investors and further enhances liquidity.

.webp)

why us

Why FDRs?

Increased Liquidity & Fractionalisation

Holding traditional assets often has a minimum investment size and limited liquidity. In contrast, investors can trade a fraction of such traditional assets in the form of FDRs on the Fusang Exchange. This fractionalisation lowers entry barriers for investors, allowing them to diversify their portfolios.

Also the smaller investment amounts make the FDR tokens more accessible to a wider range of investors to enhance liquidity and narrow bid-ask spreads.

24/7 Trading & Global Market Access

Fusang Exchange operates for 24/7 basis, offering continuous trading and investment opportunities for investors from different time zones at any time of the day or night. This accessibility can provide greater flexibility to investors and further enhance the liquidity.

legal relationship

Relationship between the underlying assets and FDRs

- Like all depository programmes, Depository is responsible for accepting transfers of the underlying assets, such as share certificates or transfer instructions.

- The underlying assets are registered in the name of the Depository or its appointed custodian (or their respective nominees) and securely safe-kept by the appointed custodian or sub-custodian.

- Depository then issues FDRs that represent an interest in the underlying assets. Like all depository receipts, FDRs give the same economic rights as direct holders of the underlying assets.

Depository

Fusang Exchange Ltd is the Depository for FDR programmes. Fusang Exchange Ltd enters into a Deposit Agreement with the Listing Sponsor of the FDR program.

Custodian of the underlying assets

All underlying assets represented by each FDR programme are held at all times by independent custodians and trustees. The custodian holds the underlying assets segregated from its other assets to ensure investor protection and bankruptcy remoteness.

Terms of the FDR programme platform

The terms of each FDR programme is governed by a Deposit Agreement, which sets out details of the arrangement, including the underlying assets represented by the FDRs. The Deposit Agreement contains terms that are binding to all holders of the FDRs and the Depository.

Trade & Settlement

FDR Trade & Settlement

FDR Listing & Trading

FDRs are listed and traded on the Fusang Exchange. Fusang Exchange is a securities exchange licensed by the Labuan Financial Services Authority.

FDR Settlement

Like for other securities exchanges, trades executed on Fusang Exchange are settled by electronic book entry. In order for securities to be traded and settled on Fusang Exchange, the securities are deposited and held in the name of Fusang Exchange’s nominee (i.e. Fusang Custody Ltd, which is a licenced trustee company holding a Hong Kong Trust or Corporate Services Provider Licence). Such securities are maintained in book entry form.

Fusang Exchange creates an account for each Fusang Exchange Member and the number of securities and funds held in book entry form for each Fusang Exchange Member are recorded and reflected in the account of that Fusang Exchange Member.

FDRs traded on Fusang Exchange are settled by adjustments to the book entry records maintained by Fusang Exchange and reflected in the Fusang Exchange Member’s account with Fusang Exchange.

All trading in FDRs is pre-funded and settlement takes place in real time immediately after execution on the Fusang Exchange.

Redemption

Redemption of underlying assets

Fusang Exchange Member can withdraw the underlying asset represented by it FDRs subject to the terms of the specific FDR programme. Generally, Fusang Exchange Member will need to have its own custodian and other arrangements to receive the transfer of the underlying assets to its own name. Some underlying assets may also have restrictions on transfer such as minimum size.

ISSUING fdrs

Request for issuing FDRs

Fusang Exchange Member can work with a Listing Sponsor or the Fusang Exchange Member can apply to be the Listing Sponsor if requisite criteria are met) to instruct Fusang Exchange to acquire underlying assets and hold them as the depository for he FDR issuance.

.webp)

OWNERSHIP

How is ownership in FDRs evidenced?

As a Fusang Exchange Member, you can opt to receive FDRs in (i) tokenised form or (ii) book entry form. Where you opt to own FDRs in book entry form, the FDRs are registered in the name of Fusang Exchange as nominee, and ownership is evidenced by the book entry records maintained by Fusang Exchange and reflected in your account with Fusang Exchange.

Beneficial ownership of the FDRs held in book entry form for your account is determined by records you as a Fusang Exchange Member maintain, to evidence ownership of the FDRs positions held by each of your clients.